Wellington Secondary College has embedded Banqer High into its ‘Financial Fitness’ elective for Year 10s, ticking every box on the Consumer and Financial Literacy strand of the Victorian Curriculum, whilst providing a highly engaging gamified format for the students. Peter Rowley-Bates, with over twenty years’ experience in the field of Business and Commerce Education, was tasked with integrating Banqer High into the elective.

Comprehensive subject coverage and an engaging format succeeds at Wellington Secondary College

Wellington Secondary College, a state school located in South-East Melbourne, has just under two thousand students. Year 10 students choose two electives per semester, giving students a taste of the subjects available from Year 11, “We also aim to provide the Year 10 students with some financial life skills and two years ago incorporated the basics such as budgeting. We wanted to take this a step further and deliver more of a personal finance elective in line with the Victorian Curriculum.”

Financial literacy is part of the Victorian Curriculum, taught through the Economics and Business ‘Consumer and financial literacy’ strand and Mathematics through a sub-strand called ‘Money and financial mathematics’. The ‘Consumer and financial literacy’ strand focuses on responsible consumer and financial decision-making at both the individual and community level, whilst the ‘Money and financial mathematics sub-strand’ provides students with the knowledge, understandings and skills necessary to make every day financial decisions.

Transforming financial fitness education at Wellington Secondary with Banqer High

Seeking a platform that would form the basis of Wellington Secondary College’s ‘Financial Fitness’ elective, Peter was recommended Banqer High by an ex-colleague. He quickly got his head around the programme and introduced it immediately to the students.

To date Peter’s students have covered banking, careers, renting and buying property and insurance, “The programme itself formed my course outline. The students work through each expansion, and I supplement it when a topic of interest comes up, for example we went into more detail on completing a report recording the condition of a rental at the start of a tenancy.”

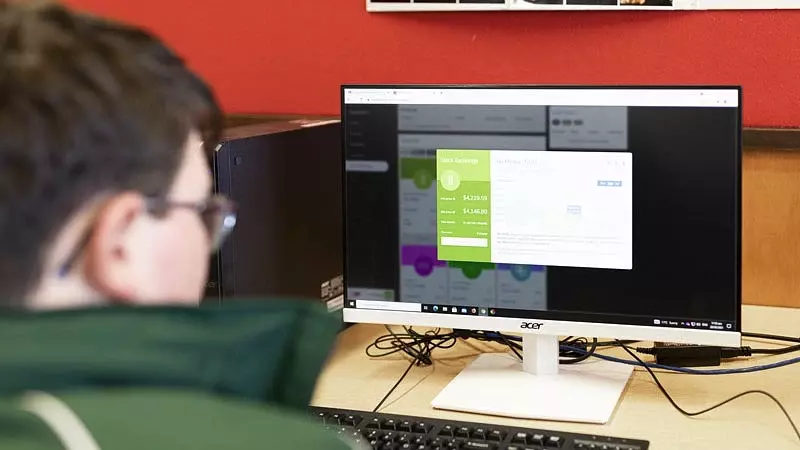

Peter has been using Banqer High throughout Melbourne’s COVID-19 lockdown, “The students enjoy the gamification of the subject and are highly engaged, completing the majority of the tasks even though we are not in an ideal situation and are teaching remotely. It beats worksheets and me talking!”

For Peter personally the benefit has been the comprehensiveness of Banqer High.

Teaching this elective for the first time, the depth and breadth of Banqer High has meant that I have not had to spend time designing a course aligned to the curriculum. The course content is already there.

Peter can also see potential for Banqer High to be included in the Victorian Certificate of Applied Learning (VCAL), an alternative to the VCE that provides a pathway to Technical and Further Education (TAFE), apprenticeships/traineeships or employment, “The practical nature of Banqer High would be of real value to the financial literacy programme offered in Year 11 and 12 as part of VCAL.”