Bradley's journey turning classroom management into real life lessons with Banqer

Bradley McDonald, an experienced educator from New South Wales, stumbled upon Banqer during his transition from teaching secondary to primary school. In his own words, he serendipitously found Banqer, which helped him survive his first year as a primary school teacher.

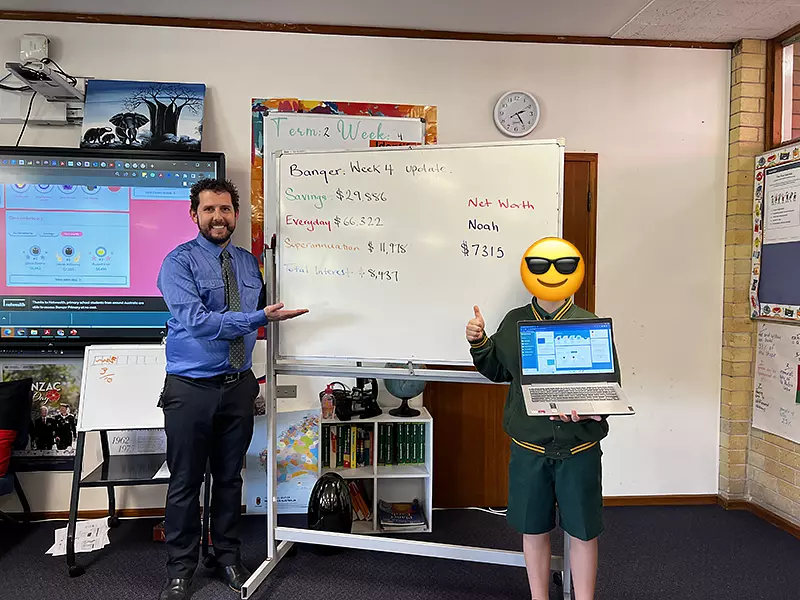

Taken with the idea of paying the students Monopoly™ money to support behaviour management in class, Bradley’s curiosity was piqued when a colleague mentioned Banqer. He signed up, impressed by the concept of the students applying for jobs and earning money, for good behaviour and achievement, and contributing to the running of the class,

Initially it was definitely the classroom management side of things that appealed, but as we worked through the expansions I realised how much more it offered in terms of insight into real life.

Resumes and real world financial lessons

Drawing from his background in pre-teaching human resources, Bradley aimed to provide his students with a genuine recruitment experience when applying for classroom jobs. “I didn’t hire them if their CVs weren’t good enough, giving them detailed feedback on why they didn’t get a job. The students started to showcase their strengths, bringing out their sporting commitments to demonstrate tenacity and so on, and understood the importance of a CV.”

As Bradley introduced the banking feature to his students, he noticed that many of them either lacked a bank account or had limited access to one. To mirror the real world, he started charging the students for using the desks, simulating the concept of leasing. “I even charged them to borrow a pen or marker if they forgot to bring their own to class. When they complained, I explained how resources cost money and that the school and taxpayers were funding all this. It really made them think!”

A financial journey seen through war, rising fuel prices, and interest rates

Bradley also brought in what was happening on the world stage, “When prices were going up due to the war in Ukraine, I started to charge them more money. They were hearing about the rise in fuel prices on the news and I was able to reflect that in class, opening up discussion around how financially connected we are globally.” By charging slightly higher fees during times of conflict, he not only reflected current events but also emphasized the practical impact on students' lives. The subsequent rise in the cash rate also triggered conversation about the effect on interest rates on their bank accounts and on repayments, with Bradley referencing his own significant increase in outgoings each month.

Understanding personal finance and the importance of planning through authentic stories

One of the key elements that made Bradley's approach to Banqer so effective was the personalisation and keeping it real. Lucky to have a local community elder available, the retired teacher and former professor & director of the Wollotuka Institute, Uncle John, shared his personal finance experiences with the students. He explained that the kids were at the beginning, Bradley was midway, and he was at the end of his financial journey, He showed them the graphs of his pension plan over the years. He talked them through global crashes, how much could be shaved off in an instant, but over all those years how much he accrued. He translated it into having approximately eighty thousand a year to live on as a pensioner, and three holidays a year, and chatted about friends who hadn’t been so careful and how they now struggled to get by.

The kids were fascinated, got the importance of saving, and started to pump money into higher risk superannuation accounts.

Currently exploring the property module with the students, Bradley has sent them home to cost up what’s in their bedrooms to illustrate the importance of contents insurance. With a touch of humor, he says, “We might have a local flood or two coming up soon!”

Bradley says of his experience with Banqer, I have found Banqer an invaluable program that has helped me transition from high school to primary and an engaging financial program that has enriched my students' learning experience. I am still on the financial literacy journey myself, and Banqer reinforces what I do know and explains what I don’t know. It provides opportunity after opportunity to get important financial life lessons across to the students in a way that is incredibly authentic.

Thanks to our Champion Partner, Netwealth, Banqer is available to primary schools across Australia at no cost.