There has been an increasing concern within schools that students stepping out of the school environment are underprepared for what lies ahead. Offering students a safe space to simulate future work and study experiences can help address this issue. Banqer High Senior complements a school’s pastoral care program and allows students to understand the consequences of their choices before stepping into the real world.

Primarily self-paced and student-led, Educators of all backgrounds can deliver Banqer High Senior. The platform simulates decisions around leaving home, career pathways and higher education, debt management and other critical choices made from the ages of 17 - 22.

This article aims to introduce the topics and concepts that students will encounter throughout their journey with Banqer High Senior, and cover some of the learning outcomes.

Click the jump links below to jump to any topic you’re interested in learning more about.

Banking Topic

The moment students log into Banqer High Senior, they embark on a transformative journey of financial literacy. Their first encounter is with the bank accounts pre-quiz, which leads them to the task of opening their first bank account, a milestone that paves the way for unlocking the next topic: career pathways.

Students are guided through the process of making transfers between accounts and payments to other accounts, cultivating essential financial skills. As students progress, they’ll encounter various topic events, designed to challenge their problem-solving abilities and teach them to grow their savings over time.

Further along in their journey, students learn the importance of vigilance in managing their finances. They will need to identify and report suspicious transactions, and learn the importance of regularly monitoring one's bank accounts. This exercise fosters responsible financial behavior, a critical aspect of personal finance.

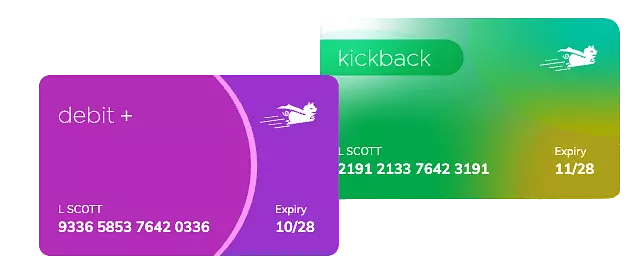

Students will explore the world of credit and debit cards. They learn how these tools can unlock the potential to purchase a range of goods and services online. Their experiences will emphasize the importance of understanding debt management. Students are guided to regularly pay off their credit card and other debts, instilling in them a sense of financial responsibility and discipline.

Budgeting Topic

Financial literacy is a crucial skill that begins with understanding the concept of budgeting. In Banqer High Senior, students are guided through the process of creating a budget while their sources of income and expenses are minimal. This provides them an opportunity to familiarise themselves with the fundamental aspects of managing personal finances.

Students gain hands-on experience by reviewing previous budgets and setting accurate future budgets. This iterative process allows them to reflect on past decisions, understand the implications of their spending habits, and make necessary adjustments for future financial planning.

Students who find themselves with a surplus in their budget are taught how to manage that surplus wisely, learning to save or invest that surplus. Conversely, students who encounter a budget deficit will be educated on how to effectively handle a shortage of funds, learn to prioritise expenses and cut back on non-essentials.

Life has a way of throwing curveballs at us when we least expect it. Banqer High Senior will stress the importance of establishing an emergency fund. Students will learn to create a separate provision within their budget for an emergency fund. They’re taught to regularly contribute to this fund, and only tap into it during times of genuine financial hardship, ensuring they have peace of mind and a safety net in place.

Careers Topic

The student-led and student-directed nature of Career Pathways means educators don't need specialised knowledge or preparation to facilitate lessons. Instead, they can focus on engaging students in meaningful dialogues and guiding them through the content. Teachers have the opportunity to enrich these conversations with their own financial journey stories, offering priceless insights into the realities of life after school.

After setting up their bank accounts in the Banking Topic, students unlock the Career Pathways Topic. They will embark on multiple journeys across Jobs, Superannuation and Higher Education, choose future careers and apply for jobs or studies that align with their aspirations. Engaging in regular check-ins to jobs or courses each school day and testing one's knowledge via regular study or job check-in quizzes helps to gauge progress.

Students will need to respond to simulated real-life scenarios that challenge understanding and require actions that are in line with one's goals. There is also flexibility to change the chosen pathway if one decides it's not for them, managing the consequences just as they would in the real world.

By the end of their journey, students will have valuable insights into life after school. Understanding the costs and benefits of different pathways, they'll be empowered to make informed decisions about their future.

Living Costs Topic

As students embark on their professional journeys, finding suitable rental accommodation that aligns with their career pathway becomes an essential task.

The first step in this topic journey is to consider various factors that will impact their daily routines. This includes the location's proximity to work and study, the number of housemates they're comfortable living with, and the condition of the property itself. Students will learn to balance these elements to ensure that the cost of accommodation doesn't become a financial burden. Students will sign a tenancy agreement and come to understand their obligations as a renter.

Various living costs arise that need to be factored into the monthly budget, such as selecting an appropriate meal plan that caters to their dietary requirements, leisure activities to ensure a healthy and balanced lifestyle, and costs of utilities such as phone, electricity and internet which they will also need to select themselves.

Engaging in hobbies or social activities not only provides relaxation but also helps in stress management, which is crucial for overall well-being. Students who lead unbalanced lifestyles will be provided with opportunities to make positive changes before more significant issues arise. Understanding the art of balance - between work and relaxation, nutrition and finance, socialisation and solitude - and utilising these insights will be key for students to lead a fulfilling and productive life.

Transport Topic

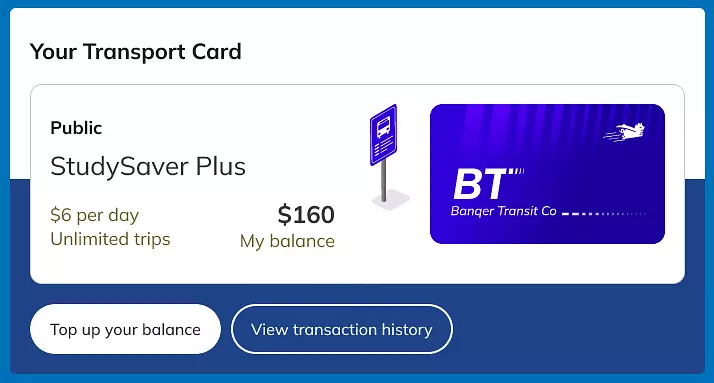

For the first time in Banqer High, the Transport topic will help students explore the cost of traveling and its financial impact. Students will need to carefully consider the cost of their daily commute - whether that's from home to work, study, or leisure activities.

Students will need to evaluate various public transport options, to understand their societal and environmental benefits. As part of this process, they'll learn about the responsibility of maintaining a travel card balance, understanding that failure to do so could lead to pricier short-term travel alternatives.

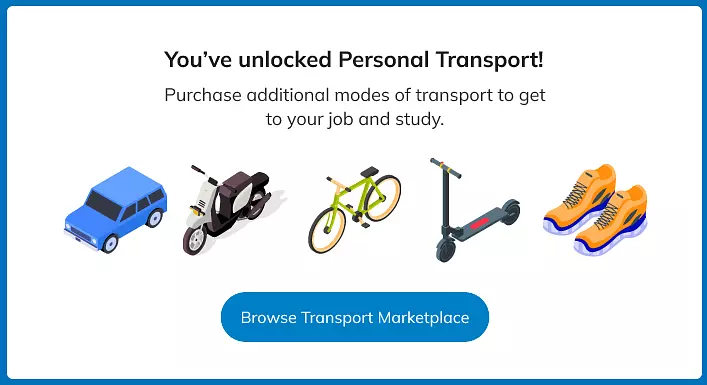

As students progress through Banqer High Senior, they'll gain access to a range of personal transport options, from cars and motorbikes to e-scooters, bicycles, and even walking. Each mode of transportation comes with its own set of running costs that students will need to factor into their budgeting.

Students who live, work, and study in different zones spread out across the landscape won't be able to rely on walking everywhere, whereas those who purchase a vehicle will be encouraged to evaluate the costs associated with financing, running, servicing, and insuring a vehicle. Potential expenses such as financing payments, fuel costs, maintenance fees, and insurance premiums will be considered. Poor planning could lead to unexpected expenses, teaching students the importance of foresight and preparation in financial management.

To further deepen the experiential learning journey, Banqer High Senior introduces a new weather system. This system influences both transport options and the condition of vehicles, adding another level of complexity for students to navigate. On days with poor weather conditions, students who usually walk or bike may need to consider alternative transport like rideshares.

Marketplace Feature

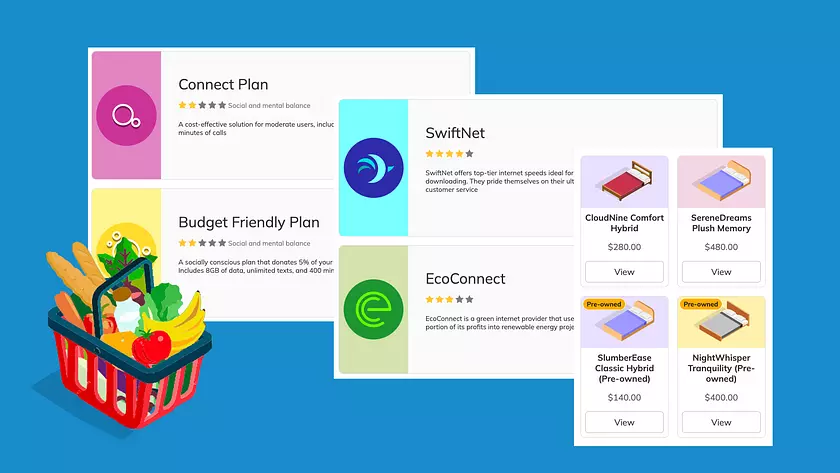

In the Banqer High marketplace, students will make decisions relating to power, internet and phone plans, meal plans, flat furnishings, transport, insurance and leisure activities, all while considering the impact on their overall well-being. Throughout the platform, students will be presented with environmentally and socially conscious options for goods and services.

A budget meal plan saves them money, but may lack nutritional value, whereas the healthiest meal plan provides the best nutritional value, but costs the most. Students will need to weigh up short term outcomes with the impact on long-term well-being and make the decision that best suits their lifestyle. Some power and internet providers may offer cheaper plans, at the cost of speed or data, while some of the higher end options may offer higher speeds or invest a portion of their profits into ethical ventures.

Students will need to weigh up costs against their personal beliefs and make choices based on what is more important to them.

Students are given the opportunity to make choices about purchases they may encounter in day-to-day life, such as choosing a phone, selecting a bed, or even deciding on various furnishings for their rental property. Each decision becomes a valuable lesson in financial management, as students are encouraged to consider multiple factors - the quality of the item, its cost, and the potential benefits it offers. Students are also given the chance to part ways with items that no longer serve their needs or fit their lifestyle by selling their used items on the marketplace, teaching them about devaluation and the practice of decluttering.

General Insurance

Students will delve into the intricacies of general insurance, a fundamental part of real life. They'll learn about the importance of protecting their assets, how insurance provides a safety net for us and our belongings, and how to evaluate various insurance policies. Platform events will simulate situations where students will appreciate the role insurance plays in mitigating the effects.

Personal Risk Insurance

Personal Risk Insurance will teach the students to understand risk management factors, health insurance and personal income insurance. They will experience the benefits, impacts, and tradeoffs of different insurance options, giving them a well-rounded understanding of this factor of financial planning.

Investing

Investing in the stock market can be an effective way to grow wealth. However, it can also be daunting for those unfamiliar with its workings. Banqer High Senior introduces students to the world of stock investments, challenging them to analyse and assess their options. In doing so, they'll learn about the risks and rewards associated with investing and the importance of diversification over time.

Learning outcomes and reporting

Our approach is underpinned by the contemporary Education 4.0 Taxonomy (World Economic Forum, 2023), comprising three core aptitudes: attitudes and values, abilities and skills, and knowledge and information. It places special emphasis on the first two aptitudes, as these are recognized by experts and employers as critical in preparing students for the world of tomorrow. Banqer High Senior, will map the three Education 4.0 aptitudes across all our topics - from budgeting and living costs to study and employment.

By aligning our pedagogy with the World Economic Forum's guidelines, as visualised above, we ensure our students develop a spectrum of transferable skills, preparing them for success in their young adult lives.

One of the key features of Banqer High Senior is its ability to provide detailed insights into student progression across the three Education 4.0 aptitudes. With a comprehensive view of each student's learning journey available on the teacher dashboard, educators can easily identify students who may need additional support.

This feature also facilitates seamless reporting to all stakeholders. For school leaders, this serves as an invaluable tool for assessing the platform’s return on investment and for developing the school leaver’s profile report.