Nayland College’s focus on financial literacy

Rob Ikink, Head of Department for Economics and Business, describes Nayland College’s forward thinking approach to financial literacy, “For the last fifteen years we have offered a Personal Financial Skills course in Year 12 which counts towards NCEA Level 2, the content of which the Ministry of Education shared widely to other schools during COVID.”

Recognising the crucial need for financial skills among junior students, the College added an optional six-month Financial Literacy module to Year 9 three years ago, “Students are starting to make financial decisions at age thirteen and fourteen. Initially, uptake wasn’t great – until we changed the name to ‘Money, Money, Money’ and then lo and behold, we had enough students for two half year cohorts!”

Integrating Banqer High with the Nayland college approach

When Banqer reached out, Rob could immediately see the potential application of Banqer High to the six-month ‘Money, Money, Money' module. His colleague, Kaiako Pāngarau, Rachael Purdie elaborates, We have two seventy-five minute lessons a week, so we decided to use Banqer High for a whole session every two or three weeks when we are introducing a new expansion, doing the introductory quiz and the practical activities. Then we check into Banqer High every lesson for up to twenty minutes to monitor progress.”

Integrating Banqer High into the 'Money, Money, Money' course was a smooth process. Rachael shares,

I have a commerce degree but have predominantly been teaching maths, so I found the resources in Banqer High to be amazing – the worksheets, activities and even the glossaries. I could log on as a demo student and do the quiz and the activities that they were going to do, such as setting up automatic payments, and feel confident I could help out when the students had a go. The support from Banqer from the get-go was fabulous too.

Gamifying Course Content with Banqer High's Realistic Simulations

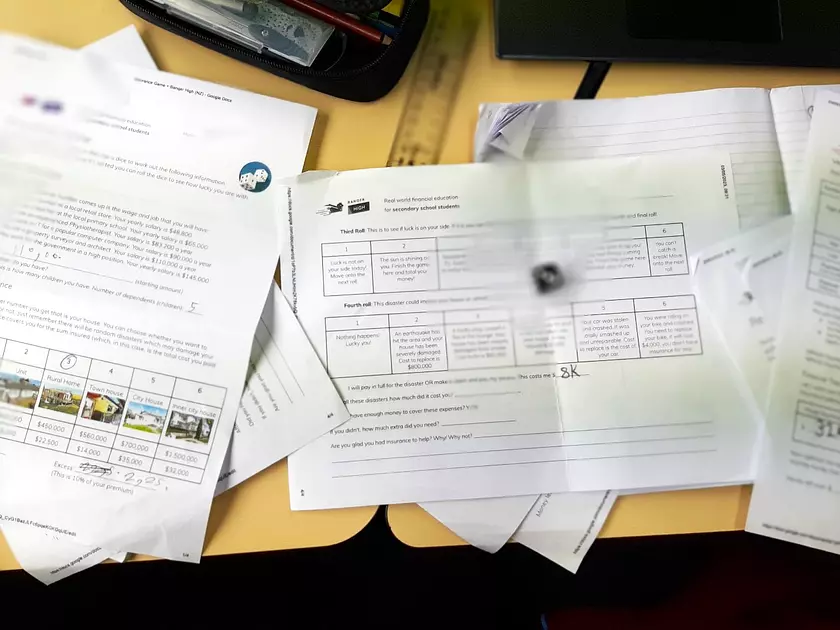

Rob and Rachael used Banqer High to bring real-life scenarios into their teaching. The platform gamified course content, giving students a firsthand understanding of online banking and decision-making. “Take insurance, for example. We played the game where you roll a die and get given a salary, then roll again and get allocated a policy with a premium and excess. Then a whole bunch of disasters happen! The students really grasped how random life can be, with trees falling on cars and so on. Then they had to decide, based on their salary and policy, if they got the car fixed or used their insurance and paid the excess.”

With the support of Partners Life, Banqer High was made accessible for Nayland College this year. Beyond just providing access, Partners Life also played a key role in helping design the Personal Risk Insurance expansion. As the class was diving into the expansion, Nelson was unfortunately hit by devastating flooding, and Rachael’s oven malfunctioned, providing even more food for thought for the class, “You can overlay what is going on in our own lives on top of the realism of the Banqer High platform. When we were looking at car insurance, which the students will be thinking about very soon, many of them had no understanding of third-party insurance. Playing Banqer High brought this home to them.”

Impact on student decision-making

Rachael lists a number of examples where the course and Banqer High had an immediate impact on students,

One boy used the CV he created to quit his paper run and get a better job. The same student’s dad had also set up a Sharesies account for him so we could draw on that knowledge when doing the stock market expansion.

Another student queried her own bank statement, “This student had never questioned what all the numbers were on her statement but now she understood compound interest, she wanted to know why the numbers had changed. You can see them directly applying what they are learning to outside the classroom.”

One boy learned a valuable lesson from his experience in Banqer High. After gambling away all his gems, he found himself bankrupt. “He recognised that he had made bad decisions and talked about how he would have to earn his way out of the hole he had got himself into. He was learning that actions have consequences but in a safe environment, rather than in the real world.”

Boosting Student Engagement

For Rachael, one of the biggest successes was seeing the heightened engagement from the students, “This group of students are always very motivated but Banqer really gripped them. They would share conversations that they had at home and I think they felt quite empowered to be able to have those discussions.”

The gamification aspect of Banqer also played a significant role in this increased engagement.

Because there are five different ways to achieve, including net worth or gems earned, I found students who aren’t overly engaged with school as a whole or aren’t particularly digitally savvy were getting into it and were able to do well. It was a real confidence booster for some kids, giving them a chance to shine.

Banqer High offers Nayland College students a unique and engaging platform to apply their financial literacy knowledge in a practical, enjoyable setting. This hands-on experience prepares them for real-world decision-making, enhancing their understanding and confidence. As an added benefit, Banqer High enriches the existing life skills programme, further contributing to its success.