Maungaraki School Year 5/6 teachers use Banqer Primary throughout the syndicate, embedding the platform into their planning for the year. It frequently plays a significant part in their inquiry focus, the teachers benefitting from Banqer’s appeal across all students, no matter their motivation or learning style.

Kim Webby, one of the syndicate teachers at the Hutt Valley school, started using Banqer four years ago and is a passionate advocate for the importance of teaching financial education, “Over the last few years I have seen the difference Banqer makes to the children’s grasp of financial literacy and I have had such positive feedback, particularly from parents who wish that older siblings had been able to use Banqer. It is so important for a child’s future financial well-being to be able to understand how to create wealth.”

Leveraging Banqer to support inquiry learning

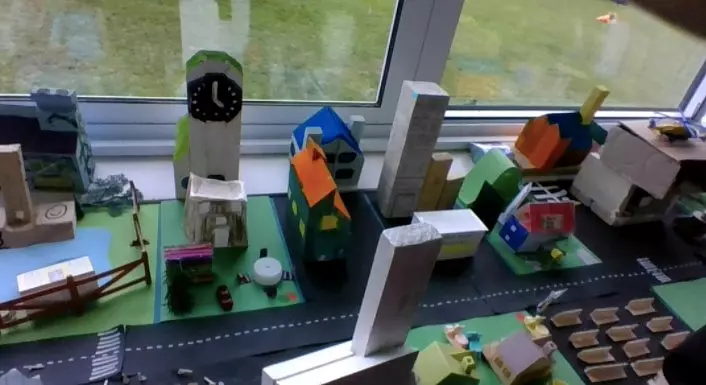

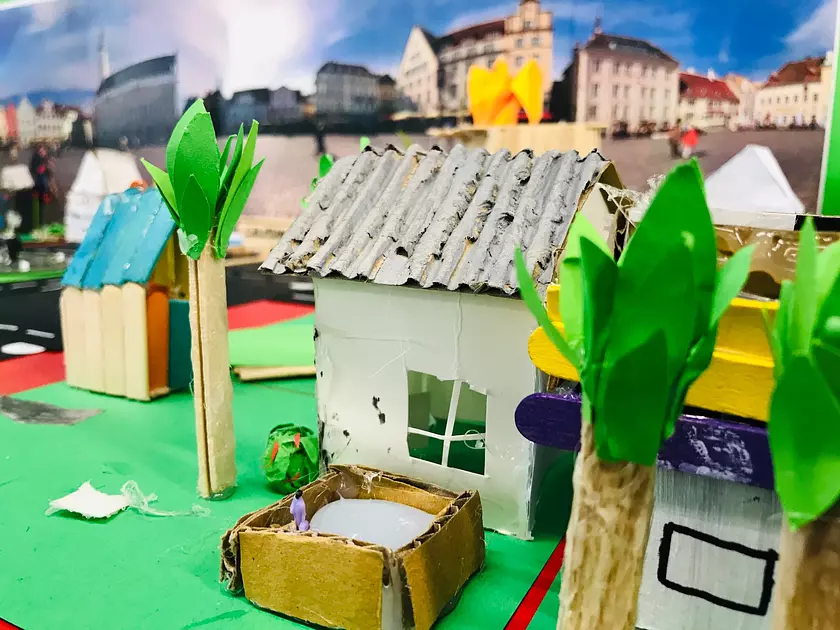

The teachers frequently embed Banqer into their inquiry for the year. Kim recalls the first time, “Coming back to school after COVID many students were anxious and we wanted to do something really fun and engaging. We decided to develop an inquiry module around property. Banqer formed the framework for the whole unit, starting with the career expansion to get jobs to raise money for deposits, then moving onto mortgages to buy a plot of land in our Banqer City.”

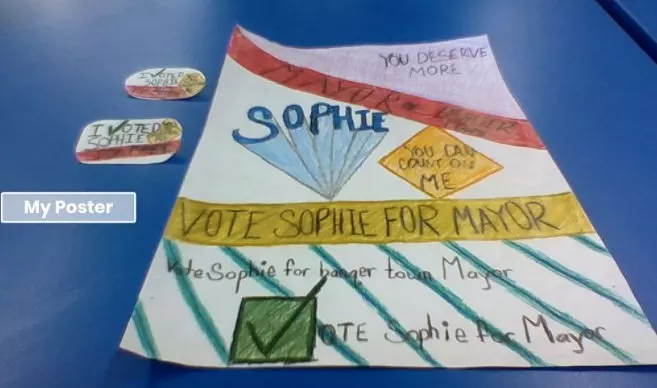

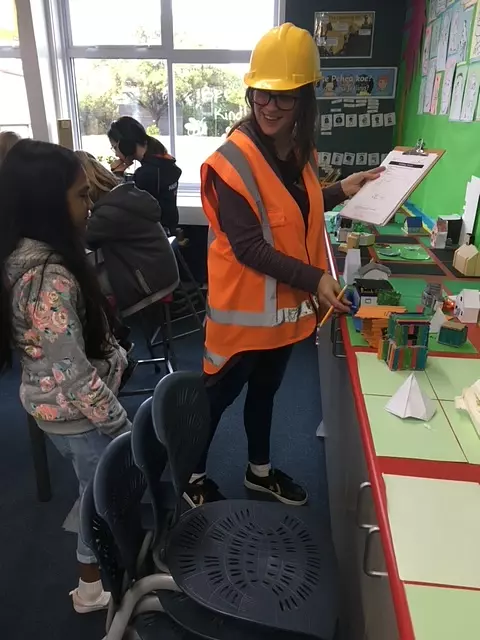

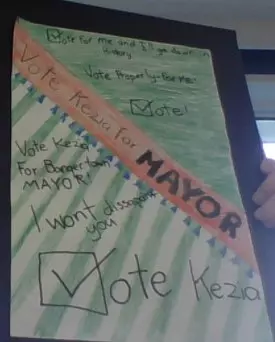

The students then designed and constructed the houses, “They even applied for consent from our class council. We had student inspectors in hi-viz and voted for a mayor. The children were so excited, wanting to earn more money to build add-ons such as pools and tree houses and buy the little cars I found. The financial literacy benefits were immense. They learned the importance of saving for a deposit, mortgages, credit scoring and also gained an understanding of what councils do, deeds and LIM reports. They thoroughly enjoyed it and we have done something similar with the students converting shoe boxes into apartments to build Banqer Towers!”

Appealing to individual learning styles

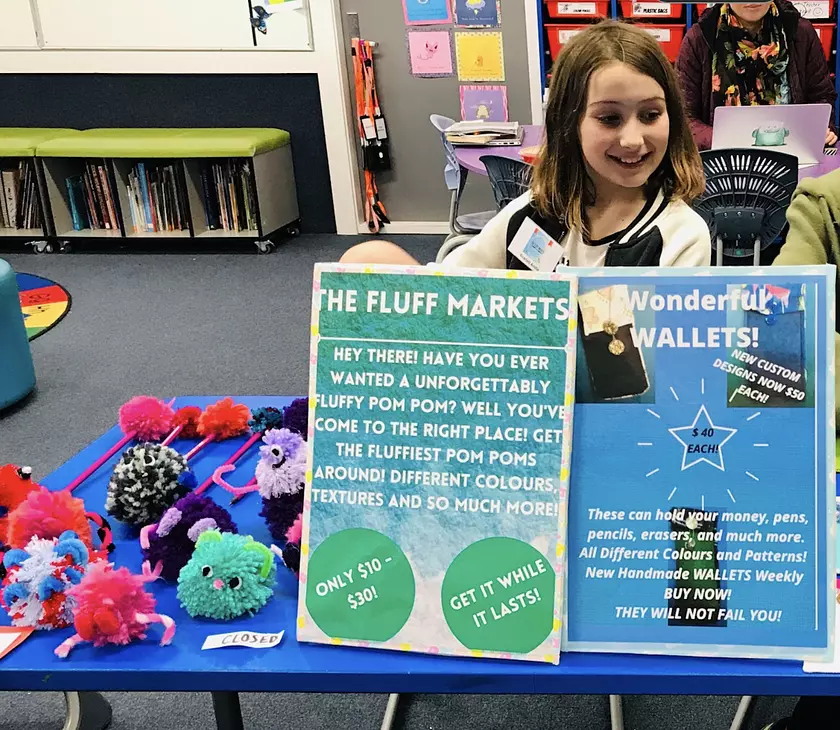

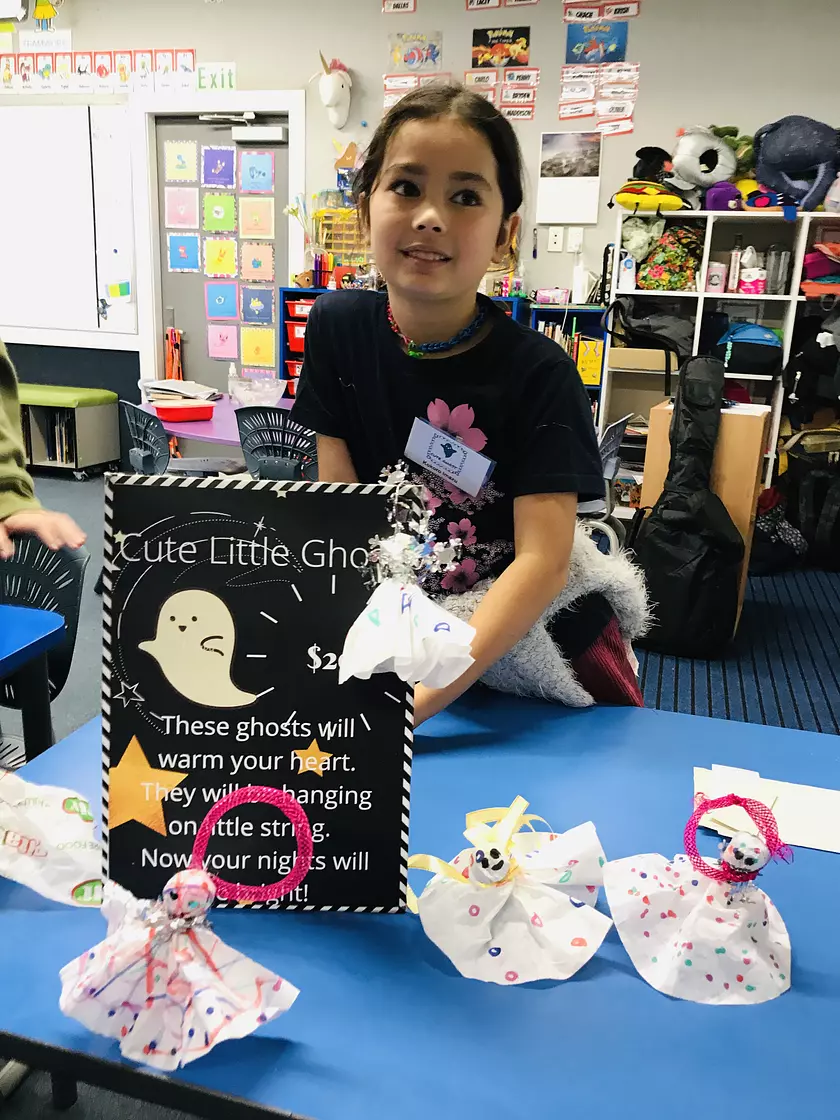

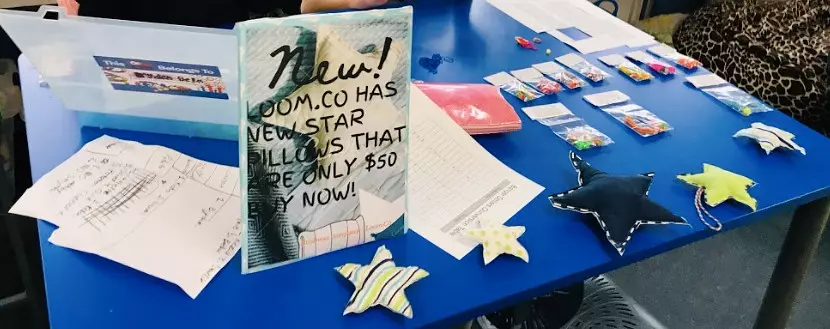

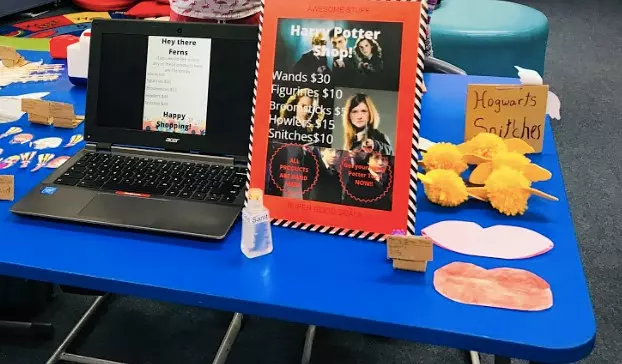

Kim has noticed that just like in the real world, students prefer to create wealth in different ways, “Some get really into the buying and selling of assets, others prefer to develop a product and set up a business, and others want to do a job and earn money.” As a result, Kim makes sure that all these options are available every year, “I have a range of jobs either in class or linked to our inquiry and a Banqer Shop on a Friday where students can sell their creations.”

“I have a group of boys who are competing with each other and sharing advice to try and make a million buying and selling real estate and others using our Banqer Shop to prototype and test products before our school Market Day. No matter the route they take, they can all get themselves into a financial hole and then we’ll have conversations to unpack where they have gone wrong and how to make sensible financial choices. They are all learning the same thing, the importance of creating managing wealth but Banqer provides the flexibility to cater for different students’ motivations.”

Banqer Primary is extremely well thought out. It takes the very broad subject of financial education that even adults struggle to get to grips with and gives the students a real world experience pitched at their level.

Teaching students credit scores

Kim takes credit scores, available in Banqer Primary thanks to our Support Partner Equifax, as an example, “The children can see their credit score in the dashboard and we discuss what it means, what impact it has, and what effects it, for example missing an automatic payment. We use the Banqer worksheets and encourage the students to chat about it at home with parents. Banqer Primary succeeds in educating the students about credit ratings in a way that engages and makes them care because they want to be able to buy or build a property or get a personal loan.”

Students don’t make the same financial mistakes twice

Kim is in the fortunate position of being able to see how much the students really take on board because her class uses Banqer in both Year 5 and Year 6, “At the start of the academic year the Year 6 students put some money away, use term deposits, are careful about borrowing and avoiding an overdraft, and once they have debt, they make sure they are servicing it. Whereas the Year 5s will be far less sensible and quite often end up in a financial pickle!"

The chance to use Banqer again in Year 6 gives the students an opportunity to put into practice what they have learned, and they are a lot more successful second time round. They don’t make the same mistakes twice!

Banqer at the heart of the Year 5/6 programme

Banqer Primary has become an integral part of being in Year 5 and 6 at Maungaraki School, “Children love making money and love spending money so there is the motivation. Banqer Primary is easy to navigate and user-friendly. It has an amazing teacher resources hub and wonderful introductory videos for the students, plus it links to the literacy and numeracy curriculum. We have our Banqer jobs set up, our Banqer shop on Fridays, build Banqer into our planning for the year and into our classroom management system, and send out the Banqer parent emails to keep families up to date with what we are doing. Banqer is one of the most purposeful activities that we do in class.”

Banqer Primary is available at no cost to all New Zealand primary schools thanks to our Champion Partner, Kiwibank